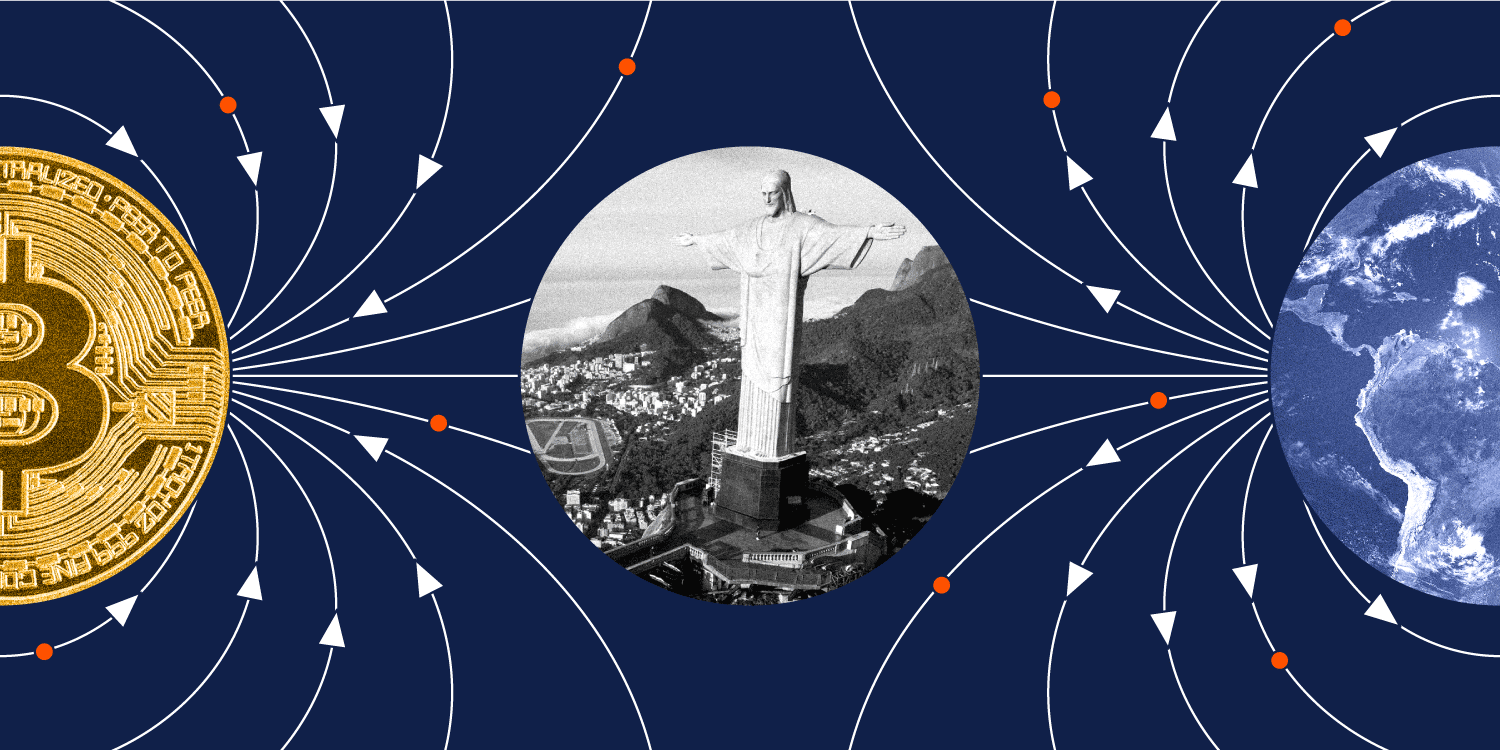

Once heralded as a financial revolution, then dismissed as a bubble, cryptocurrency is quietly staging a comeback—and Latin America is leading the charge. From Buenos Aires to Bogotá, governments, startups, and everyday citizens are rethinking how money moves, saves, and spends in a region long plagued by inflation, currency instability, and limited access to traditional banking.

🌎 A Region Ready for Reinvention

Latin America has become an unlikely hotspot for crypto experimentation—not because it’s trendy, but because it’s necessary.

In Argentina, where annual inflation hit 138% in 2024, the peso has lost much of its purchasing power. Many Argentines have turned to stablecoins, such as USDT and USDC, to protect their savings, make online purchases, or receive freelance payments from abroad.

“It’s not about speculation anymore,” said Lucía Menéndez, a freelance designer in Rosario. “Crypto is how I pay rent and buy groceries.”

A recent report by Chainalysis ranked Argentina, Venezuela, and Brazil among the top 20 countries in crypto adoption globally, with millions of users accessing digital wallets daily.

🏦 Central Banks Watching Closely

In response to rising adoption, governments in Latin America are starting to take crypto more seriously—not just as a threat, but as a tool for innovation.

In Brazil, the central bank has launched a pilot for Drex, its new central bank digital currency (CBDC). Unlike decentralized cryptocurrencies, Drex is state-backed and designed to streamline financial inclusion in a country where nearly 30 million people are unbanked.

“CBDCs could offer stability without ignoring the digital trend,” said economist João Carvalho. “The key will be coexistence, not competition.”

Meanwhile, El Salvador, the first country to adopt Bitcoin as legal tender, continues to double down on its bet. Its government recently announced the launch of a Bitcoin Bond aimed at attracting foreign investment and funding infrastructure projects.

🧠 Fintech Rising

Private sector innovation is also booming. Latin American fintechs are now offering services that blend traditional finance with blockchain tools.

-

Belo, an Argentine wallet, allows users to spend crypto with prepaid debit cards.

-

Lemon Cash and Bitso now serve over 7 million users across Argentina, Brazil, and Mexico.

-

Buenbit, once a crypto-only app, now integrates local fiat currencies, bridging the gap between old and new money.

“Crypto is part of our regional identity now,” said Martín Ferrari, CEO of Lemon. “We’re building tools for the next economy—borderless, fast, and user-led.”

🔥 Not Without Risks

Of course, challenges remain. The collapse of FTX, regulatory ambiguity, and price volatility have all left scars. Many users lost funds in 2022 and are only cautiously reentering the space.

Governments, too, are concerned about money laundering and fraud, and regulatory frameworks remain fragmented across the region.

“We need protection without suffocation,” said Colombian fintech lawyer Andrea Pardo. “If we overregulate, innovation dies. If we underregulate, users suffer.”

📈 What’s Next?

-

More countries are exploring CBDCs and stablecoin regulation.

-

Cross-border remittances—a $142 billion market in Latin America—are increasingly processed using blockchain.

-

Small businesses are beginning to accept crypto directly to avoid bank fees and FX losses.

What was once seen as speculative has now become an essential tool in navigating economic uncertainty—especially for youth and digital workers.

“Crypto is no longer a protest—it’s a solution,” said Uruguayan developer Sofía Delgado. “And Latin America is where it’s becoming real.”

💬 Community Voice

How is crypto being used in your city or country?

Has it helped—or hurt—your business, savings, or daily life?

Drop your thoughts in the comments or tag @NowPress with your story.